MIPS Performance Feedback reports are released in the summer each year and show a provider or practice what payment adjustment to expect for the coming year. Once payments start to be processed for applicable dates of service, many providers want to confirm how these amounts are being applied, and may want to report on or track these payments throughout the year.

There are three codes to look for on a Remittance Advice (RA) that indicate MIPS payment adjustments:

- CO-144 indicates a positive payment adjustment:

- The glossary shows “CO: Contractual obligations. The patient may not be billed for this amount.” and “144: Incentive adjustment, e.g. preferred product/service.”

- This will be associated with the dollar amount adjustment to the claim.

- CO-237 indicates a negative payment adjustment (penalty):

- This shows in the glossary as “237: Legislated/Regulatory Penalty. At least one Remark Code must be provided (may be comprised of either the NCPDP Reject Reason Code, or Remittance Advice Remark Code that is not an ALERT.)”

- This will be associated with the dollar amount adjustment to the claim.

- In either case, there is an additional remark code, N807: “Payment adjustment based on the Merit-based Incentive Payment System (MIPS).”

One very important thing to keep in mind, depending on how you are viewing these amounts, is that they are categorized as adjustments on the RA. Adjustments, by default, show as a positive number on a paper or printed RA. For example, look at any contractual adjustment under CO-45: these show a positive dollar amount with no minus sign in front of it, even though we all know that amount is being deducted from the charge and will not be paid.

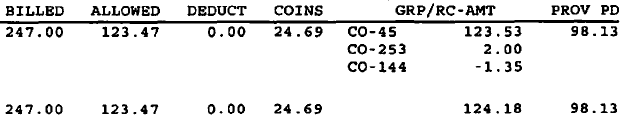

Why does this matter? Because your MIPS payment adjustments may look the opposite of what you expect! Here is an example of a claim that received a 2% sequestration reduction (CO-253), and a 1.37% positive MIPS payment adjustment (CO-144):

The initial contractual adjustment is $123.53, but $2.00 is added to that adjustment for sequestration, and there is a $1.35 REDUCTION in the adjustment to reflect the POSITIVE MIPS payment adjustment (remember from math class – a negative of a negative number is a positive number, so a negative adjustment is a positive payment). The MIPS adjustment results in an overall adjustment of $124.18 instead of $125.53, and therefore a $1.35 higher payment to the provider.

MIPS payment adjustments may not apply to all line items on a claim, and may not be applied to the full allowed amount:

- Payment adjustments are only applied to the amount Medicare will pay, not any patient cost-sharing amounts.

- MIPS adjustments are applied before sequestration reductions.

- Adjustments are only applied to “covered professional services,” so some items such as drugs or DME are not subject to the adjustment.

For more information on how to access your MIPS Performance Feedback, see the article here.