The 2021 final MIPS performance feedback was released last week, along with the corresponding payment adjustment information. If you are a MIPS-eligible clinician and have not reviewed your feedback yet, make sure to do so before October 21. October 21 is the deadline to submit a targeted review request if you believe anything in your results is incorrect.

Check your eligibility here (no login required, just enter an NPI): https://qpp.cms.gov/participation-lookup

Check your performance feedback by logging in here (HARP account required): https://qpp.cms.gov/

(New QPP portal users, check out my article here about how to create a HARP account and get linked to a provider or practice in the QPP portal).

Positive Adjustments

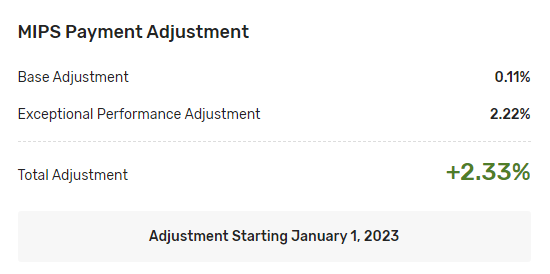

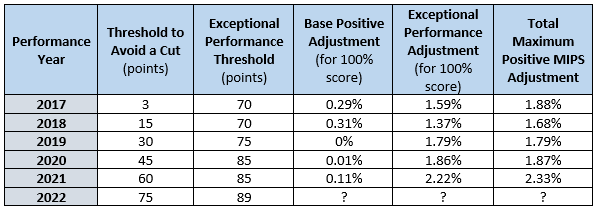

For 2021 MIPS performance, the maximum upward adjustment earned for a 100% MIPS score is 2.33%. This is the highest in MIPS history, although still far below previous estimates from many sources, including CMS. The Performance Feedback also provides the breakdown of how much of that adjustment was earned based on performance above the minimum threshold to avoid a cut (in 2021, 60 points), and how much was based on the Exceptional Performer pool of bonus money (reserved for scores above 85 points). As in past years, nearly all of the upward adjustment came from the Exceptional Performer bonus pool:

MIPS is mostly a budget-neutral program. This means that any bonus money paid out to high performers has to come from other providers who received a payment cut. In other words, for one provider or practice to be rewarded, others have to fail. Since there was a blanket exception for 2021 MIPS due to COVID, providers who would otherwise have received a cut did not have to report, so there was very little money from payment cuts to distribute to high performers.

The one exception to budget neutrality is the Exceptional Performance pool of money. For payment adjustments tied to performance years 2017 – 2022, there is an additional $500 million pool of funds for the highest performers, above and beyond what comes from payment cuts. This pool of money has been funding almost all of the upward adjustments in MIPS since the program’s inception. The threshold to avoid a cut has been very attainable each year, and blanket COVID exceptions for 2019 through 2021 almost certainly reduced the number of providers who would have received a cut, resulting in very few cuts to fund the base adjustments for those who earned upward MIPS adjustments:

Performance year 2022 is the last year Exceptional Performance bonus money is available, so that, combined with a threshold of 75 points to avoid a cut, will likely make for the highest upward adjustments the program has offered so far to top performers.

Negative Adjustments

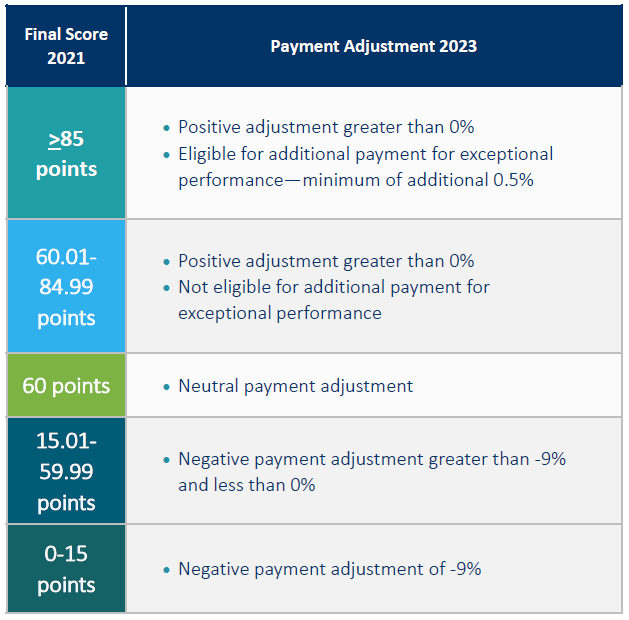

While positive payment adjustments are based on how much money is available and how many providers earned it, negative payment adjustments are based strictly on a MIPS score below the payment adjustment threshold, which was 60 points in 2021:

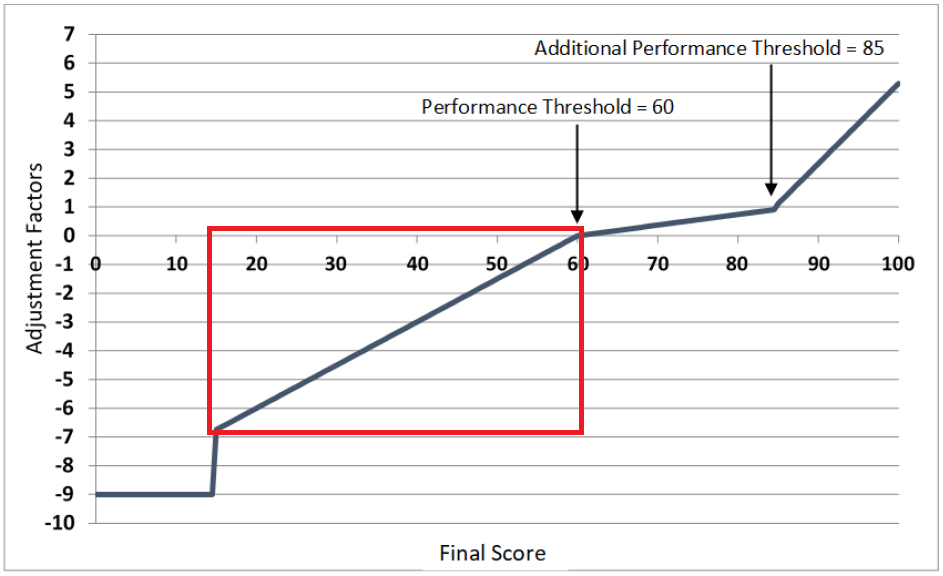

The bottom 25% of all scores below 60 points received the maximum 9% cut. For 2021 scores in the 15.01 – 59.99 range, the cuts are distributed in a straight line from 6.75% to 0.01%:

This means that while positive adjustments cannot be calculated by anyone other than CMS, and only after all data has been submitted and scored, negative adjustments can be calculated in advance for any potential MIPS score in the highlighted section of the line above (scores in the top 75% below the threshold for a cut). The general formula is:

( [Threshold to avoid a cut] – [Projected MIPS score] ) x ( [Maximum negative adjustment] ÷ [Threshold to avoid a cut] )

The first part calculates how far below the threshold a given score is, then multiplies this by the adjustment amount as an adjustment-per-point number. To simplify it, the formula for 2022 for scores between 18.76 and 74.99 (since scores at 18.75 or lower get the full 9% cut):

(75 – [Projected MIPS score] ) x ( -0.09 ÷ 75 )

While no one wants a negative payment cut, the above is very useful for cost/benefit analyses. There are providers and practices for whom the cost of avoiding a cut completely would be higher than their return on investment, especially for those who are only barely MIPS-eligible, with eligible charges in the $90,000 – $150,000 range, and especially those without an EHR or with a less-than-cooperative EHR. For these practices, a 1% or 2% cut might be less than what it would cost to get to neutral. The key is to stay out of the bottom 25% who receive the maximum cut, which is still very easily attainable with some minimum reporting.

For more information on how to find MIPS payment adjustments on a Remittance Advice, see the article here.

For help figuring out how to avoid a payment cut or maximize your incentive, reach out for a free consultation.